| • | | Voluntary termination upon the election or appointment, as applicable, of a new Chairman and/or Chief Executive Officer.The applicable named executive officer is not entitled to receive any payments after the date of termination. |

The employment agreements with Mssrs. Bredow and Henley were amended on February 19, 2013 by the Committee to increase the payments due them upon retirement, termination without cause or voluntary termination within one year after a change in control from 50% of annual base salary to 100% of annual base salary. In addition, the payment for outplacement services was also changed from $50,000 to $100,000. These changes were made to make the provisions in the employment agreements for Mssrs. Bredow and Henley more consistent with the provisions in Mr. Saville’s employment agreement.

Conditions to Receipt of Payment

The covenants within the employment agreements include non-compete provisions, including the prohibition from:

engaging, on the individual’s or another entity’s behalf in the homebuilding or mortgage businesses as an employee, greater than 1% owner, manager or otherwise;

| • | | engaging, on the individual’s or another entity’s behalf in the homebuilding or mortgage businesses as an employee, greater than 1% owner, manager or otherwise; |

|

| • | | inducing or attempting to induce any customers or potential customers from conducting business with us; |

|

| • | | hiring or attempting to hire our employees; or |

|

| • | | utilizing the services of or trying to acquire land, goods or services from, any of our developers or subcontractors. |

inducing or attempting to induce any customers or potential customers from conducting business with us;

hiring or attempting to hire our employees; or

utilizing the services of or trying to acquire land, goods or services from any of our developers or subcontractors.

42

The periods that the non-compete provisions cover are as follows:

During their term of employment with us, the named executive officers are bound by the non-compete covenants at all times.

| • | | During their term of employment with us, the named executive officers are bound by the non-compete covenants at all times. |

|

| • | | For two years after termination, the named executive officer is bound by the non-compete covenants if the termination was voluntary, due to retirement, for cause, or without cause. |

|

| • | | The named executive officer is not bound by the non-compete covenants after their termination date if the termination was voluntary within one year after a change in control, or voluntary upon the election or appointment, as applicable, of a new Chairman and/or Chief Executive Officer. |

For one year after termination, the named executive officer is bound by the non-compete covenants if the termination was voluntary, due to retirement, for cause, or without cause.

The named executive officer is not bound by the non-compete covenants after their termination date if the termination was voluntary within one year after a change in control, or voluntary upon the election or appointment, as applicable, of a new Chairman and/or Chief Executive Officer.

Stock Option and Restricted Share Unit Agreements

Each option agreement provides for the acceleration of vesting of all unvested options if we experience a “change in control” (as defined below). SeeCompensation Discussion and Analysis — Fixed Price Stock Optionsabove. The accelerated vesting is based on a single trigger, meaning that the named executive officer does not need to terminate employment to receive the acceleration right. The “change of control” provisions within the named executive officers’ agreements are identical to the “change of control” provisions within the agreements for all other participants of the respective stock option plans. Generally, the “change of control” provision is triggered upon:

| • | | our merger, consolidation, reorganization or other business combination with one or more other entities in which we are not the surviving entity; |

|

| • | | our selling substantially all of our assets to another entity; or |

|

| • | | our experiencing any transaction resulting in any person or entity owning 20% or more of the total number of our voting shares, or any person commencing a tender or exchange offer to acquire beneficial ownership of 20% or more of the total number of our voting shares. |

our merger, consolidation, reorganization or other business combination with one or more other entities in which we are not the surviving entity;

42

our selling substantially all of our assets to another entity; or

our experiencing any transaction resulting in any person or entity owning 50% or more of the total number of our voting shares.Assuming we experienced a change of control on December 31, 2009,2012, the market value realized on the accelerated stock options for each of the named executive officers would be as follows:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Market Price | | | | |

| | | | | | | | | | | of NVR | | | | |

| | | Number of | | Option | | Common | | Per Share | | Market Value |

| | | Options | | Exercise | | Stock at | | Intrinsic Value | | Realized on |

| | | Accelerated | | Price | | 12/31/09 | | at 12/31/09 | | Acceleration |

| Name | | (#) | | ($) | | ($) | | ($) | | ($) |

| Dwight C. Schar | | | — | | | | — | | | | — | | | | — | | | | — | |

| Paul C. Saville: | | | | | | | | | | | | | | | | | | | | |

| 2000 Option Plan | | | 25,000 | | | $ | 515.05 | | | $ | 710.71 | | | $ | 195.66 | | | $ | 4,891,500 | |

| William J. Inman: | | | | | | | | | | | | | | | | | | | | |

| 2000 Option Plan | | | 9,000 | | | $ | 515.05 | | | $ | 710.71 | | | $ | 195.66 | | | $ | 1,760,940 | |

| Dennis M. Seremet: | | | | | | | | | | | | | | | | | | | | |

| 2000 Option Plan | | | 13,000 | | | $ | 515.05 | | | $ | 710.71 | | | $ | 195.66 | | | $ | 2,543,580 | |

Robert W. Henley: | | | | | | | | | | | | | | | | | | | | |

| 2000 Option Plan | | | 6,000 | | | $ | 515.05 | | | $ | 710.71 | | | $ | 195.66 | | | $ | 1,173,960 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Number of

Stock

Awards

Accelerated

(#) | | | Number of

Options

Accelerated

(#) | | | Option

Exercise

Price

($) | | | Market Price

of NVR

Common

Stock at

12/31/12

($) | | | Per Share

Intrinsic Value

at 12/31/12

($) | | | Market Value

Realized on

Acceleration

($) | |

Paul C. Saville: | | | | | | | | | | | | | | | | | | | | | | | | |

2000 Option Plan | | | — | | | | 57,344 | | | $ | 703.00 | | | $ | 920.00 | | | $ | 217.00 | | | $ | 12,443,648 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 12,443,648 | |

Dennis M. Seremet: | | | | | | | | | | | | | | | | | | | | | | | | |

2010 Equity Plan | | | — | | | | 24,261 | | | $ | 703.00 | | | $ | 920.00 | | | $ | 217.00 | | | $ | 5,264,637 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 5,264,637 | |

Robert W. Henley: | | | | | | | | | | | | | | | | | | | | | | | | |

2000 Option Plan | | | — | | | | 11,028 | | | $ | 703.00 | | | $ | 920.00 | | | $ | 217.00 | | | $ | 2,393,076 | |

2010 Equity Plan | | | — | | | | 10,000 | | | $ | 844.50 | | | $ | 920.00 | | | $ | 75.50 | | | | 755,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 3,148,076 | |

Eugene J. Bredow: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan | | | — | | | | 333 | | | $ | 505.37 | | | $ | 920.00 | | | $ | 414.63 | | | $ | 138,072 | |

2000 Option Plan | | | — | | | | 3,970 | | | $ | 703.00 | | | $ | 920.00 | | | $ | 217.00 | | | | 861,490 | |

2010 Equity Plan | | | — | | | | 8,000 | | | $ | 804.80 | | | $ | 920.00 | | | $ | 115.20 | | | | 921,600 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 1,921,162 | |

43

Deferred Compensation Plans

Under the deferred compensation plans (see the2012 Non-Qualified Deferred Compensation Tableabove for more information on these plans), each named executive officer receives a lump sum distribution immediately if we experience a “change of control”, rather than receiving their account balance at separation of service. The “change of control” provisions within the deferred compensation plans are equally applicable to all participants within the plans.

| • | | Plan 1.Generally, the “change of control” provision is the same as the “change in control” provision set forth in our stock option agreements, as summarized above. |

|

| • | | Plan 2.Generally, the “change of control” provision is triggered if (i) we experience any transaction resulting in any person or entity owning 50% or more of the total fair market value or total voting power of our shares, (ii) we experience any transaction resulting in any person or entity acquiring 35% or more of the total fair market value or total voting power of our shares during a 12-month period, (iii) a majority of our board of directors is replaced during any 12-month period by new directors not endorsed by a majority of our board of directors who were on our board immediately preceding the new appointments or elections, or (iv) we sell to another entity our assets that have a total gross fair market value equal to or more than 40% of the total gross fair market value of our total assets. |

Assuming a change of control under the deferred compensation plans at December 31, 2009,2012, the market value of the accelerated account balances is presented in the2012 Non-Qualified Deferred Compensation Plans Tableabove.

43

********20092012 DIRECTOR COMPENSATION TABLE

| | | | | | | | | | | | | |

| | | Fees Earned or | | | | | | | |

| | | Paid in Cash | | | Option Awards | | | Total | |

| Name | | ($)(3) | | | ($) (4) (5) | | | ($) | |

Dwight C. Schar(1) | | | — | | | | — | | | | — | |

| C. E. Andrews | | $ | 53,200 | | | | — | | | $ | 53,200 | |

C. Scott Bartlett, Jr.(2) | | $ | 27,400 | | | | — | | | $ | 27,400 | |

| Robert C. Butler | | $ | 56,400 | | | | — | | | $ | 56,400 | |

| Timothy M. Donahue | | $ | 48,400 | | | | — | | | $ | 48,400 | |

| Alfred E. Festa | | $ | 54,800 | | | | — | | | $ | 54,800 | |

| Manuel H. Johnson | | $ | 64,800 | | | | — | | | $ | 64,800 | |

| William A. Moran | | $ | 38,800 | | | | — | | | $ | 38,800 | |

| David A. Preiser | | $ | 50,000 | | | | — | | | $ | 50,000 | |

| W. Grady Rosier | | $ | 48,400 | | | | — | | | $ | 48,400 | |

| John M. Toups | | $ | 48,400 | | | | — | | | $ | 48,400 | |

| Paul W. Whetsell | | $ | 46,800 | | | | — | | | $ | 46,800 | |

| | | | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($)(1) | | | Stock Awards

($) (2) | | | Option Awards

($) (3) | | | Total

($) | |

Dwight C. Schar | | $ | 37,200 | | | | — | | | | — | | | $ | 37,200 | |

C. E. Andrews | | $ | 53,200 | | | | — | | | | — | | | $ | 53,200 | |

Robert C. Butler | | $ | 58,000 | | | | — | | | | — | | | $ | 58,000 | |

Timothy M. Donahue | | $ | 51,600 | | | | — | | | | — | | | $ | 51,600 | |

Thomas D. Eckert | | $ | 46,800 | | | | — | | | | — | | | $ | 46,800 | |

Alfred E. Festa | | $ | 53,200 | | | | — | | | | — | | | $ | 53,200 | |

Manuel H. Johnson | | $ | 68,000 | | | | — | | | | — | | | $ | 68,000 | |

Mel Martinez | | $ | 3,767 | | | $ | 455,319 | | | $ | 455,355 | | | $ | 914,441 | |

William A. Moran | | $ | 37,200 | | | | — | | | | — | | | $ | 37,200 | |

David A. Preiser | | $ | 51,600 | | | | — | | | | — | | | $ | 51,600 | |

W. Grady Rosier | | $ | 51,600 | | | | — | | | | — | | | $ | 51,600 | |

John M. Toups | | $ | 51,600 | | | | — | | | | — | | | $ | 51,600 | |

Paul W. Whetsell | | $ | 51,600 | | | | — | | | | — | | | $ | 51,600 | |

| (1) | | |

(1) | | Effective February 4, 2009, Mr. Schar relinquished his executive officer title but continues to serve as the Chairman of the Board, and will be paid the same fees as our other non-management directors. The director fees that he earned in 2009 are included above in the2009 Summary Compensation Table. |

|

(2) | | Mr. Bartlett’s term as a director expired at the May 2009 Annual Meeting and he did not stand for re-election. |

|

(3) | | All non-employee Board members are paid a $26,000 annual retainer. Mr. Johnson, the Audit Committee Chairman, is paid an additional annual retainer of $10,000 for serving in that capacity. Non-employee Board members are paid fees of $1,600 for each Board and Committee meeting attended during 2009.attended. Mr. Martinez was appointed to the Board on December 1, 2012, and thus earned one-twelfth of the annual retainer plus applicable meeting fees for December 2012. Reasonable incidental travel and out-of-pocket business expenses are reimbursed as incurred in accordance with the policies to which all of our executive officers and employees are subject. |

44

| (2) | The amounts disclosed represent the aggregate grant date fair value of restricted share unit grants made to Mr. Martinez upon his appointment to the Board on December 1, 2012 in accordance with FASB ASC Topic 718, disregarding any estimate of forfeitures relating to service-based vesting conditions. The fair value valuation for restricted share units is equal to the market value per share of NVR stock on the date of grant, which was $899.84 per share. |

(4)(3) | The amounts disclosed represent the aggregate grant date fair value of stock option grants made to Mr. Martinez upon his appointment to the Board on December 1, 2012 in accordance with FASB ASC Topic 718, disregarding any estimate of forfeitures relating to service-based vesting conditions. The fair value tranche-weighted assumptions for the grant is as follows: i) the estimated option life is 5.5 years, ii) the risk free interest rate was 0.8% (based on a U.S. Treasury Strip due in a number of years equal to the estimated option life), iii) the expected volatility equals 31.2%, and iv) the estimated dividend yield is 0%. |

Narrative Disclosure to Director Compensation Table

The cash paid to our directors in the form of the $26,000 annual retainer and the $1,600 per meeting fee has not changed since 2000, other than increasing the Audit Committee Chairman’s annual retainer to $36,000, which occurred in 2003. When the last benchmarking analysis was prepared for our Board by Aon Hewitt in 2010, the average annual cash compensation paid to our Board was only slightly above the 25th percentile of director cash compensation when compared to a survey of director compensation for companies with revenue between $2.5 billion and $5.0 billion.

In 2010, upon the recommendation of the Compensation Committee, the Board adopted a Board compensation structure under which cash compensation levels were maintained and the annual long-term incentive plan (“LTIP”) component was increased. The LTIP component mirrors the LTIP approved for management, including the named executive officers, whereby 50% of any award value is payable in time-vested restricted share units, and the other 50% is payable in time-vested stock options. Upon being appointed to the Board on December 1, 2012, Mr. Martinez’s compensation package followed that structure. The grant date fair value of Mr. Martinez’s equity awards was consistent with the value of the awards issued to our existing Board members in 2010 and 2011.

The following table sets forth the outstanding stock option and restricted share unit awards for our directors at December 31, 2012:

45

| | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | | | Number of

Shares or Units

of Stock That

Have Not Vested | | | Market Value of

Shares of Stock

That Have

Not Vested | |

Dwight C. Schar | | | | | | | | | | | | | | | | | | | | | | | | |

2000 Option Plan(a) | | | — | | | | 28,672 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

C. E. Andrews: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(b) | | | 1,047 | | | | — | | | $ | 637.10 | | | | 05/05/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

Robert C. Butler: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 434 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

Timothy M. Donahue: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 1,302 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

Thomas D. Eckert: | | | | | | | | | | | | | | | | | | | | | | | | |

2010 Equity Plan(d) | | | — | | | | 2,035 | | | $ | 669.85 | | | | 11/30/21 | | | | — | | | | — | |

2010 Equity Plan(e) | | | — | | | | — | | | | — | | | | — | | | | 680 | | | $ | 625,600 | |

Alfred E. Festa: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(f) | | | 1,592 | | | | — | | | $ | 434.25 | | | | 11/30/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

Manuel H. Johnson: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 1,302 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

Mel Martinez | | | | | | | | | | | | | | | | | | | | | | | | |

2010 Equity Plan(g) | | | — | | | | 1,688 | | | $ | 899.84 | | | | 11/30/22 | | | | — | | | | — | |

2010 Equity Plan(h) | | | — | | | | — | | | | — | | | | — | | | | 506 | | | $ | 465,520 | |

William A. Moran: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 434 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

David A. Preiser: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 1,302 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

W. Grady Rosier: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(f) | | | 531 | | | | — | | | $ | 434.25 | | | | 11/30/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

John M. Toups: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 1,302 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

Paul W. Whetsell: | | | | | | | | | | | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | 1,302 | | | | — | | | $ | 515.05 | | | | 01/02/18 | | | | — | | | | — | |

2010 Equity Plan(a) | | | — | | | | 1,764 | | | $ | 703.00 | | | | 05/10/20 | | | | — | | | | — | |

| (a) | NoneThese options were granted on May 11, 2010. The exercise price of the directors received a grantoptions was equal to the market value of the underlying stock on the date of grant. The options during 2009. |

|

(5) | | The following table sets forth the outstanding stock option awards for our directors atvest in fifty percent increments on each of December 31, 2009, excluding Mr. Schar’s outstanding grant awards which are disclosed in the aboveOutstanding Equity Awards at December 31, 2009 Tablefor the named executive officers:2013 and 2014, with vesting based solely upon continued services being provided as a director. |

44

| | | | | | | | | | | | | | | |

| | | Number of | | | | | | | | | |

| | | Securities | | | Number of | | | | | | |

| | | Underlying | | | Securities | | | | | | |

| | | Unexercised | | | Underlying | | | Option | | | |

| | | Options | | | Unexercised | | | Exercise | | | Option |

| | | (#) | | | Options | | | Price | | | Expiration |

| Name | | Exercisable | | | (#) Unexercisable | | | ($) | | | Date |

| C. E. Andrews: | | | | | | | | | | | | | | |

1998 Option Plan(a) | | | — | | | | 1,047 | | | $ | 637.10 | | | 05/05/18 |

| Robert C. Butler: | | | | | | | | | | | | | | |

1998 Option Plan(b) | | | 12,000 | | | | — | | | $ | 369.75 | | | 04/30/12 |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| Timothy M. Donahue: | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| Alfred E. Festa: | | | | | | | | | | | | | | |

1998 Option Plan(d) | | | — | | | | 1,592 | | | $ | 434.25 | | | 11/30/18 |

| Manuel H. Johnson: | | | | | | | | | | | | | | |

2000 Option Plan(e) | | | 17,000 | | | | — | | | $ | 189.00 | | | 05/02/11 |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| William A. Moran: | | | | | | | | | | | | | | |

2000 Option Plan(e) | | | 4,250 | | | | — | | | $ | 189.00 | | | 05/02/11 |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| David A. Preiser: | | | | | | | | | | | | | | |

2000 Option Plan(e) | | | 8,000 | | | | — | | | $ | 189.00 | | | 05/02/11 |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| W. Grady Rosier: | | | | | | | | | | | | | | |

1998 Option Plan(d) | | | — | | | | 1,592 | | | $ | 434.25 | | | 11/30/18 |

| John M. Toups: | | | | | | | | | | | | | | |

2000 Option Plan(e) | | | 17,000 | | | | — | | | $ | 189.00 | | | 05/02/11 |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| Paul W. Whetsell: | | | | | | | | | | | | | | |

1998 Option Plan(c) | | | — | | | | 1,302 | | | $ | 515.05 | | | 01/02/18 |

| | |

(a) | (b) | The options were granted on May 6, 2008. The exercise price of the options was equal to the market value of the underlying stock on the date of grant. Mr. Andrews received a grant of 1,047 options, which vestsvested in one-third increments on each of December 31, 2010, 2011 and 2012, with vesting based solely upon continued services being provided as a director. |

|

(b) | | The options were granted on May 1, 2002. The exercise price of the options was equal to the market value of the underlying stock on the date of grant. Mr. Butler received a grant of 17,000 options, which vest in 25% increments on each of December 31, 2006, 2007, 2008 and 2009, with vesting based solely upon continued services being provided as a director on the vesting dates. |

|

| (c) | | The options were granted on January 3, 2008. The exercise price of the options was equal to the market value of the underlying stock on the date of grant. The applicable director received a grant of 1,302 options, which vestsvested in one-third increments on each of December 31, 2010, 2011 and 2012, with vesting based solely upon continued services being provided as a director. |

| (d) | The options were granted on December 1, 2011. The exercise price of the options was equal to the market value of the underlying stock on the date of grant. Mr. Eckert received a grant of 2,035 options, which vests in fifty- |

46

| | percent increments on each of December 31, 2015 and 2016, with vesting based solely upon continued services being provided as a director. |

(d)(e) | These restricted share units were granted on December 1, 2011. They vest in fifty percent increments on each of December 31, 2013 and 2014, with vesting based solely upon continued services being provided as a director. |

| (f) | The options were granted on December 1, 2008. The exercise price of the options was equal to the market value of the underlying stock on the date of grant. The applicable director received a grant of 1,592 options, which vestsvested in one-third increments on each of December 31, 2010, 2011 and 2012, with vesting based solely upon continued services being provided as a director. |

|

(e)(g) | | TheThese options were granted on May 3, 2001.December 1, 2012. The exercise price of the options was equal to the market value of the underlying stock on the date of grant. The applicable directorMr. Martinez received a grant of 17,0001,688 options, which vestvests in 25%fifty-percent increments on each of December 31, 2006, 2007, 20082016 and 2009,2017, with vesting based solely based upon continued services being provided as a directordirector. |

| (h) | These restricted share units were granted on theDecember 1, 2012. They vest in fifty percent increments on each of December 31, 2014 and 2015, with vesting dates.based solely upon continued services being provided as a director. |

45

Stock Holding Requirements

To linkfurther align the interests of our Board of Directors with our shareholders, we adopted stock ownership guidelines for directors in 2000. These guidelines require the members of our Board of Directors to acquire and continuously hold a specified minimum level of our shares for so long as they serve as directors. Under our holding requirements, Board members must acquire and hold shares with a total fair market value equal to five times the annual boardBoard retainer fee, which is $130,000 for all of the Board members, with the exception of Mr. Johnson whose holding requirement is $180,000 due to his higher annual board retainer. Board members must satisfy the holding requirement within three years of first becoming subject to the holding requirements, and at a minimum, have satisfied one-third of the requirement after one year, and two-thirds of the requirement after two years. All members of our Board of Directors are in compliance with our stock ownership guidelines.

46

47

APPROVALOF INDEPENDENT AUDITORS

Approval of Independent Auditors

(Proposal 2)

At the Annual Meeting, our Board of Directors will recommend shareholder ratification of the appointment of KPMG LLP as our independent auditor for the year 2010.2013. KPMG LLP served as our independent auditor for the year 2009.2012. If the appointment is not ratified, the Board will consider whether it should select another independent auditor. Representatives of KPMG LLP are expected to be present at the meeting to respond to shareholders’ questions and will have an opportunity to make a statement if they so desire.

The number of votes cast for the proposal must exceed the number of votes cast against the proposal for approval of the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING“FOR” THE APPROVAL OF KPMG LLP

AS NVR’S INDEPENDENT AUDITORSAUDITOR FOR 2010.2013.

DISCLOSURE OF FEES PAID OR INCURRED FOR KPMG LLP DURING THE YEARS ENDED DECEMBER 31:

| | | | | | | | | |

| | | 2009 | | | 2008 | |

| Audit fees: | | | | | | | | |

| Integrated audit of financial statements, Internal controls over financial reporting and quarterly reviews | | $ | 570,000 | | | $ | 621,397 | |

| Comfort letters and consent | | | — | | | | 56,000 | |

| SEC comment letter | | | 2,600 | | | | — | |

| Adoption of SFAS No. 167 | | | 15,000 | | | | — | |

| Reimbursable expenses | | | 3,150 | | | | 6,704 | |

| | | | | | | |

| Total audit fees | | | 590,750 | | | | 684,101 | |

| | | | | | | | | |

| Audit-related fees: | | | | | | | | |

| Employee benefit plan audit | | | 37,653 | | | | 37,653 | |

| Tax fees | | | — | | | | — | |

| All other fees | | | — | | | | 15,560 | |

| | | | | | | |

| | | | | | | | | |

| Total fees | | $ | 628,403 | | | $ | 737,314 | |

| | | | | | | |

| | | | | | | | |

| | | 2012 | | | 2011 | |

Audit fees: | | | | | | | | |

Integrated audit of financial statements, internal controls over financial reporting and quarterly reviews | | $ | 650,100 | | | $ | 605,000 | |

Comfort letters and consents | | | 50,000 | | | | — | |

Reimbursable expenses | | | 1,500 | | | | 5,150 | |

| | | | | | | | |

Total audit fees | | | 701,600 | | | | 610,150 | |

Audit-related fees: | | | | | | | | |

Employee benefit plan audit | | | 40,000 | | | | 40,000 | |

Tax fees | | | — | | | | — | |

All other fees | | | — | | | | — | |

| | | | | | | | |

Total fees | | $ | 741,600 | | | $ | 650,150 | |

| | | | | | | | |

The Audit Committee annually evaluates what types of audit and non-audit services (permitted by law) that, subject to certain limits, can be entered into with pre-approval authority granted by the Audit Committee and will grant that authority, if applicable, pursuant to an Audit Committee resolution. For the years 20092012 and 2008,2011, under separate authorizations applicable to each respective year, the Audit Committee delegated to our Chairman of the Audit Committee (the “Chairman”), CEO and CFO, together or separately, in our name and on our behalf, the authority, subject to individual cost limits, to engage KPMG LLP to perform 1) accounting guidance and technical assistance for the implementation of newly issued accounting pronouncements and standards, 2) accounting guidance and technical assistance related to the application of existing accounting pronouncements and standards to our transactions, and 3) SEC registration statement comfort letters and consents, together in an aggregate amount for all services not to exceed 50% of the

47

annual audit fee, provided that the Chairman, the CEO and CFO reported any such audit-related or non-audit services to the full Audit Committee at its next regularly scheduled meeting.

During 2012, $50,000 of fees related to a comfort letter and consent were paid pursuant to the delegated authority granted by the Audit Committee. All fees incurred during

2009 and 20082011 were approved directly by our Audit Committee.

48

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Proposal 3)

Pursuant to the requirements of the Wall Street Reform and Consumer Protection Act, we are providing our shareholders an opportunity to indicate whether they support our named executive officer compensation as described in this proxy statement. This advisory vote, commonly referred to as “say on pay,” is not intended to address any specific item of compensation, but instead relates to the compensation paid to the named executive officers as disclosed in this proxy statement, including the Compensation Discussion and Analysis, the tabular disclosures regarding named executive officer compensation, and the narrative disclosure accompanying the tabular presentations. These disclosures allow you to view the trends in our executive compensation program and the application of our compensation philosophies for the years presented. We are currently holding “say on pay” advisory votes on an annual basis. The 2008next shareholder advisory vote will be held at the Annual Shareholders Meeting in May 2014.

We actively monitor our executive compensation practices in light of the industries in which we operate and the marketplace for talent in which we compete. We are focused on compensating our executive officers fairly and in a manner that incentivizes high levels of performance while providing us the tools to attract and retain the best talent. As discussed in the Compensation Discussion and Analysis included in this proxy statement, we believe that our executive compensation program properly links executive compensation to our performance and aligns the interests of our executive officers with those of our shareholders. For example:

We pay cash compensation to our named executive officers in amounts that we believe to be lower than cash compensation paid to comparable positions in other publicly traded companies within our industry.

We cap the annual cash bonus opportunity of our named executive officers at 100% of their base salary, and have not provided any opportunity to exceed that amount for “all other fees” relates to costs incurred for certain litigation support.

48

MANAGEMENT PROPOSAL TO AMEND THE ARTICLES OF

INCORPORATION AND BYLAWS TO DECLASSIFY THE BOARD OF

DIRECTORS AND ESTABLISH ANNUAL ELECTIONS

(Proposal 3)

General Information

The Board of Directors,short-term quarterly or annual performance in its continuing review of corporate governance matters, and after careful consideration and upon recommendation by Management, has adopted and now recommends shareholder approval of a proposal to amend Article 7, paragraph (a)excess of our Restated Articlesbusiness plan.

We place a substantial portion of Incorporation,total direct compensation to our executive officers at risk in the form of stock-based awards that vest over a long-term period.

Our named executive officers must achieve and maintain a designated level of ownership in NVR stock.

Accordingly, the Board unanimously recommends that shareholders vote in favor of the following resolution:

“Resolved, that the compensation paid to NVR’s named executive officers as amended (the “Articles”)disclosed in this proxy statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Section 3, paragraphs 3.02Analysis, the compensation tables and 3.04, of our Bylaws, to eliminate the classificationrelated footnotes and narrative disclosures, is hereby APPROVED.”

Although this vote is advisory and is not binding on NVR, the Compensation Committee of the Board of Directors. The Articles and Bylaws currently provide thatwill take into account the Board of Directors shall be divided into three classes, with the directors in each class standing for election at every third annual meeting of shareholders. The Board of Directors has determined that those provisions should be amended to provide instead for the annual election of all directors. The Board has unanimously adopted a resolution approving a declassification amendment to the Articles and Bylaws, which will provide for the annual election of all directors, and is recommending that our shareholders approve that amendment.

If the proposed amendments are approved, all directors would be elected to one-year terms commencing at the 2011 Annual Meeting. In order to facilitate the transition from classified three-year terms to non-classified one-year terms, each director whose term would not otherwise expire at the 2011 Annual Meeting has agreed to tender his or her resignation effective immediately prior to the 2011 Annual Meeting. The Board has set the current number of directors at 11, which the Proposal would not change. The Board will, however, retain the authority to change that number and to appoint directors to fill any Board vacancies, including any that result from an increase in the sizeoutcome of the Board.

Required Vote

The affirmative vote ofwhen considering future executive compensation decisions. For the holders of a majority of the outstanding shares of common stock is required for approval of the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR” THE PROPOSAL TO

AMEND THE RESTATED ARTICLES OF INCORPORATION AND BYLAWS TO PROVIDE

FOR THE ANNUAL ELECTION OF ALL DIRECTORS.

Background of Proposal

Classified boards have been widely adopted and have a long history in corporate law. Proponents of classified boards believe that they provide continuity and stability to the board, facilitate a long-term outlook by the board and enhance the independence of non-employee directors. On the other hand, an increasing number of investors have come to believe that classified boards reduce accountability of directors because they limit the ability of shareholders to evaluate and elect all directors on an annual basis.

The Board is committed to sound corporate governance principles and practices. Accordingly, the Board has on several occasions considered the advantages and disadvantages of

49

maintaining a classified Board, and in the past has concluded that it was in the best interests of NVR and its shareholders to maintain a classified Board. This year, upon the recommendation of Management, the Board again considered the various positions for and against a classified Board, particularly in light of evolving corporate governance practices and investor sentiment. The Board believes that the election of directors is a primary means for shareholders to influence corporate governance policies and hold management accountable for implementing those policies. The Board recognizes that annual elections are in line with current best practices in the area of corporate governance, as it provides shareholders the opportunity to register their views on the performance of the entire Board each year. Based upon our reconsideration, the Board has determined that adopting aadvisory resolution approving amendments to the Articles and Bylaws, which will provide for the annual election of all directors, is in the best interests of NVR and its shareholders at this time.

Amendment to Restated Articles of Incorporation and Bylaws

If the amendment to Article 7, paragraph (a) of the Articles is adopted pursuant to this Proposal, that section would read as follows:

The number of directors of the Corporation shall be no less than seven and no more than thirteen, as determined from time to time by the Board of Directors by resolution. Beginning with the annual meeting of shareholders to be held in 2011, each director shall hold office for a term expiring atapproved, the next annual meeting of shareholders following such director’s election and until such director’s successor is elected and qualified.Any reduction of the authorized number of directors will not have the effect of removing any director prior to the expiration of such director’s term. The existence of a vacancy on the board of directors shall not affect the validity of any action taken by the board of directors during the pendency of such vacancy.

Appendix B shows the changes to the relevant portions of Article 7, paragraph (a) of the Articles resulting from the proposed amendment, with deletions indicated by strike-outs and additions indicated by underlining. If approved, this amendment to the Articles will become effective upon the filing of a Certificate of Amendment to the Articles with the Secretary of State of the State of Virginia. We intend to make such a filing promptly if approval of the Proposal is obtained at the 2010 Annual Meeting.

If the amendment to Section 3, paragraphs 3.02 and 3.04, of our Bylaws is adopted pursuant to this Proposal, those sections would read as follows:

3.02 Composition of the Board of Directors.

The Board of Directors shall consist of no less than seven directors and no more than thirteen directors, as determined by the Board of Directors from time to time by resolution. The majority of the directors shall be independent directors. For purposes of these Bylaws, “independent director” shall mean a director who is “independent” under the listing standards of any national securities exchange upon which the corporation’s shares are listed (but not the listing standards relating to the independence of the members of audit committees). The Board, acting in good faith, shall determine whether a director is an independent director, and shall have the exclusive right and power to interpret and apply the provisions of this Section 3.02. The validity of any action taken by the Board shall not be affected by the failure to have a majority of independent directors or by the existence of a vacancy at the time such action was taken.

50

3.04 Election and Term of Office.

Except as provided in the Articles of Incorporation and Section 3.05 of these Bylaws, directors shall be elected at the annual meeting of shareholders (or at any special meeting in lieu thereof). The terms of all directors shall expire at the next annual meeting of shareholders following their election, or upon their earlier death, resignation or removal. Despite the expiration of a director’s term, the director shall continue to hold office until a successor is elected and qualifies or until there is a decrease in the number of directors. A decrease in the number of directors shall not shorten an incumbent director's term. No individual shall be named or elected as a director without his prior consent.

Appendix C shows the changes to the relevant portions of Section 3, paragraphs 3.02 and 3.04 of the Bylaws resulting from the proposed amendment, with deletions indicated by strike-outs and additions indicated by underlining. If approved, this amendment to the Bylaws will become effective immediately upon shareholder approval at the 2010 Annual Meeting.

51

MANAGEMENT PROPOSAL TO ADOPT THE 2010 EQUITY

INCENTIVE PLAN

(Proposal 4)

We are asking that our shareholders approve the 2010 Equity Incentive Plan (the “2010 Equity Plan”), which was approved by the Board on February 22, 2010. Under the 2010 Equity Plan, awards of non-qualified stock options (“Options”) and restricted share units to acquire up to 700,000 shares of our Common Stock (“Shares”) may be granted to our key management employees, including executive officers, and our Board members (“Participants”).

Required Vote

Assuming the presence of a quorum, the affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting of Shareholders is required for approval of the 2010 Equity Plan. In addition, NYSE rules require that the total number of votes cast on“FOR” the 2010 Equity Plan proposal (includingresolution must exceed the votes for or against and abstentions) represent over 50% of all votes entitled to be cast with respect to“AGAINST” the proposal.

resolution.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING“FOR”

THE PROPOSAL FOR ADOPTION OF THE 2010 EQUITY INCENTIVE

PLANFORGOING RESOLUTION.

Purpose and Importance of Plan

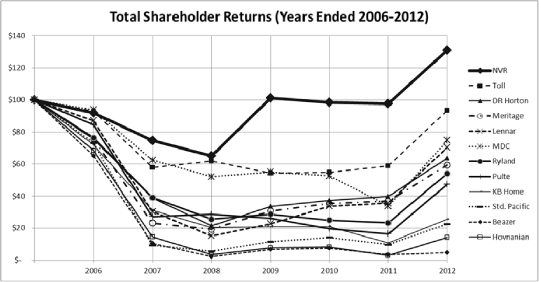

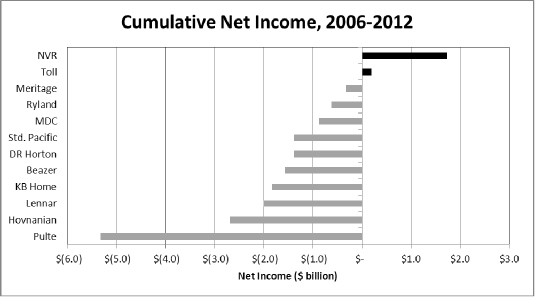

We have a long-running record of producing a high level of operating and financial performance. That performance is evidenced by the following:

| • | | Despite operating in the worst economic climate since the Great Depression, we were the only homebuilder of the 12 homebuilders on a national level to operate profitably for the 2009 and 2008 fiscal years, and for 2007, we were one of only three profitable homebuilders among the top 12. |

|

| • | | Our market capitalization leads the industry at December 31, 2009, having risen 950% over the ten-year period ending December 31, 2009, despite having 35% fewer outstanding shares as compared to the beginning of the measurement period. |

|

| • | | Our total shareholder return for the ten year period ending December 31, 2009 is a gain of 1,388.4%. The total shareholder return for the S&P 500 over that same period is a loss of 9.1%. |

NVR’s historical operating success is primarily attributable to the efforts of our employees. Retaining a loyal and experienced management team has been our number one operating strategy. That strategy and its successful implementation provide us a sizable competitive advantage because we typically seat our operating management teams in the same geographic markets throughout their careers. This enables them to become experts in the local market conditions and demographic trends for that region for marketing our homes effectively, allows them to establish long-term relationships with the best land developers and subcontractors in the area, and ensures that they have a thorough understanding of all local government homebuilding laws, rules and regulations. Our top five homebuilding senior managers average over 22 years with us, and our profit center homebuilding managers average 18.5 years of service with us. This employee retention focus also extends to our corporate leadership: our top eight corporate

52

49

SHAREHOLDER PROPOSALS

officials average over 17 years of employment, and Mr. Saville, our CEO, and Mr. Seremet, our CFO, have served NVR for approximately 29 years and 22 years, respectively. Simply put, we view our employees as are our most important asset.

Our prior stock option plans have significantly aided us in the long term retention of our key management employees. We do not issue stock option grants annually. Rather, we have historically issued grants every three to four years, and our granting strategy has employed a “layered” approach by granting options such that there is one grant actively vesting over a four-year period, with another grant in a four to five year pre-vesting period (in essence, two plans outstanding at any given time but vesting occurs sequentially). We believe this structure ensures that our executives are focused on driving shareholder value over a long-term period and it has been a highly successful retention vehicle for us.

However, as of present, none of our key managers or executive officers is tied to a long-term incentive plan after December 31, 2010. This condition is a result of the termination of the 2005 Stock Option Plan (“2005 Plan”) that our shareholders approved at the 2005 Annual Meeting. For the 2005 Plan, we revised our option program to require both performance and service-based vesting conditions. Under this 2005 Plan, no option would have become exercisable unless a performance target based on growth in diluted earnings per share (the “EPS Target”) was met. The EPS Target was set at a level that reflected a growth rate in diluted earnings per share of 10% per year for four years, based on our 2004 diluted earnings per share of $66.42, amounting to aggregate EPS of $339.00 per share over the four-year period ending December 31, 2008. Because of the downturn in the homebuilding industry and the general economy that began in the latter half of 2005, we failed to meet the 4-year aggregate performance measure. Therefore, the grants made to all plan participants, including the grants made to the named executive officers, expired unexercised on December 31, 2008. Further, because the EPS Target was a condition of the 2005 Plan itself, the 2005 Plan has expired and no further stock options grants may be made under it. Had the EPS Target been attained as the first condition of vesting, the stock option grants issued under the 2005 Plan would have vested in 25% increments on December 31, 2010, 2011, 2012 and 2013 based on continued employment.

Thus, we are faced with having no long-term incentive plan post-December 31, 2010 for our named executive officers and other key managers. In addition to our belief that an effective long term incentive plan is essential to the long-term retention of our named executive officers and key managers as discussed above, we are faced with certain immediate employee retention issues. First, as general market conditions begin to improve, we are more vulnerable than we were in 2007 and 2008 to employee turnover as our competitors begin to expand under the improved conditions. In addition, our success during the downturn has led to more of our competitors moving towards the “asset lite” business model that we have successfully employed (see the operating and financial statistics cited above). This increases the risk that our competitors will attempt to hire away our key managers who are expertly versed in our “asset lite” model. We are also faced with the risk that we could lose a certain demographic segment of our key management group to retirement before certain succession candidates are adequately trained and experienced.

Further, it is equally important to provide stock option grants to new managers as we continue to grow our business coming out of the over four-year economic downturn. We must have the ability to attract and competitively compensate high-quality personnel to assist us in our growth objectives. The length of the vesting period (through 2014) of the proposed 2010 Equity Plan is uniquely suited to assist us in providing long term incentives for new management to accomplish our various business objectives.

By placing a large portion of compensation at risk through equity compensation plans, the future economic interests of key members of management are linked directly to those of our shareholders. Since the first stock option plan was adopted by shareholders in 1993, our market value per share has risen dramatically. From the period December 31, 1993 to December 31, 2009, NVR’s market value per share has grown from $9.75 per share to $710.71 per share. To further solidify the direct link between management and our shareholders, the Board has taken additional steps by mandating NVR Share ownership guidelines. Under the Stock Ownership Guidelines (the “Guidelines”) adopted by the Board in 2000, the Chief Executive Officer, Executive Officers and certain other key management personnel must acquire and hold Shares with a total fair market value ranging from one (1) to eight (8) times their annual base salaries depending upon their respective level of responsibility. The 2010 Equity Plan will assist our management in complying with the ownership guideline requirements.

To combat the retention risks noted above, if approved, we are altering our historical approach and intend to issue half of the total award value in time-vested restricted share units that will vest in 2011 and 2012, and half of the award value in fixed-price stock options that will vest in 2013 and 2014. The restricted share units aid in bridging the impact caused by the termination of the 2005 Option Plan so that we can return to our preferred method of solely issuing fixed-price stock options. The Compensation Committee discussed the advisability of using a performance metric to earn the restricted share units; however, after fully vetting the matter, it was determined to be inappropriate due to the current unstable business climate. We have performed macro-level calculations to determine the 700,000 share size for which we are seeking approval, which is intended to provide grants to both current and future employees as we hire for future growth. However, we have not yet specifically set grant awards for any of the intended current participants, including for the named executive officers.

53

We recognize that the number of equity grants proposed for the 2010 Equity Plan, combined with the number of options outstanding under existing plans, exceeds the current dilution thresholds for employee equity compensation plans recommended by certain organizations. However, we feel that we have effectively managed any potential dilution from our stock option plans. Since 1993 we have repurchased approximately 20.8 million shares of our common stock, which is almost 2.5 times the total number of equity granted to employees and directors over the same time period.

We believe that it is in the best interest of NVR and its shareholders to approve the 2010 Equity Plan for the reasons described above. The Board of Directors approved and adopted the 2010 Equity Plan on February 22, 2010, subject to shareholder approval. Shareholder approval of the 2010 Equity Plan is required by the New York Stock Exchange listing rules, and so that the Options may qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code.

Additional Equity Plan Information:

As of March 5, 2010 (the record date), there were 837,813 stock options outstanding with a weighted average exercise price of $377.00 and a weighted average remaining life of 4.24 years. The following table sets forth additional information regarding stock options outstanding as of the record date:

| | | | | | | | | | | | | |

| | | | | | | Weighted | | Weighted Average |

| | | Options | | Average | | Remaining Years of |

| | | Outstanding | | Exercise Price | | Contractual Life |

| Substantially in-the-money options outstanding in excess of six years | | | 373,154 | | | $ | 209.16 | | | | 1.36 | |

| Options outstanding in excess of six years not continuously in the money since vest date | | | 57,800 | | | $ | 453.74 | | | | 3.38 | |

| Options outstanding in excess of six years not vested | | | 22,402 | | | $ | 353.82 | | | | 3.01 | |

| All options outstanding less than six years | | | 384,457 | | | $ | 529.71 | | | | 7.25 | |

| Totals | | | 837,813 | | | $ | 377.00 | | | | 4.24 | |

For purposes of RiskMetrics Group’s Stock Option Carve Out Policy, “substantially in-the-money options outstanding in excess of six years” is defined as the in-the-money options outstanding in excess of six years that have been continuously in-the-money after they were vested. Additional information regarding these options is as follows:

| | | | | | | | | | | | | | | | | |

| | | | | | | Remaining | | | | | | Number of |

| Grant Date | | Vesting Schedule of Original Grant | | Contractual Life | | Exercise price | | Options |

| | 08/02/2000 | | | 33 1/3% on 12/31/03, 04 and 05 | | | 0.41 | | | $ | 62.13 | | | | 336 | |

| | 09/05/2000 | | | 33 1/3% on 12/31/00, 01 and 02 | | | 0.50 | | | $ | 72.00 | | | | 7,000 | |

| | 05/03/2001 | | | 25% on 12/31/06, 07, 08 and 09 | | | 1.16 | | | $ | 189.00 | | | | 322,203 | |

| | 11/01/2001 | | | 25% on 12/31/06, 07, 08 and 09 | | | 1.66 | | | $ | 158.30 | | | | 1,125 | |

| | 12/01/2001 | | | 25% on 12/31/06, 07, 08 and 09 | | | 1.74 | | | $ | 181.50 | | | | 675 | |

| | 01/21/2002 | | | 25% on 12/31/06, 07, 08 and 09 | | | 1.88 | | | $ | 202.05 | | | | 625 | |

| | 05/01/2002 | | | 25% on 12/31/06, 07, 08 and 09 | | | 2.16 | | | $ | 369.75 | | | | 4,250 | |

| | 07/29/2002 | | | 25% on 12/31/06, 07, 08 and 09 | | | 2.40 | | | $ | 278.00 | | | | 6,750 | |

| | 08/01/2002 | | | 25% on 12/31/06, 07, 08 and 09 | | | 2.41 | | | $ | 288.50 | | | | 1,100 | |

| | 08/05/2002 | | | 25% on 12/31/06, 07, 08 and 09 | | | 2.42 | | | $ | 269.35 | | | | 375 | |

| | 09/01/2002 | | | 25% on 12/31/06, 07, 08 and 09 | | | 2.49 | | | $ | 296.50 | | | | 925 | |

| | 10/25/2002 | | | 25% on 12/31/07, 08, 09 and 10 | | | 2.64 | | | $ | 338.00 | | | | 1,875 | |

| | 11/11/2002 | | | 25% on 12/31/07, 08, 09 and 10 | | | 2.69 | | | $ | 313.12 | | | | 750 | |

| | 12/02/2002 | | | 20% on 12/31/07, 08, 09, 10 and 11 | | | 2.75 | | | $ | 331.00 | | | | 500 | |

| | 12/02/2002 | | | 10.5% on 12/31/06, 07, 08 and 09 and 29% on 12/31/10 and 11. | | | 2.75 | | | $ | 331.00 | | | | 1,000 | |

| | 01/21/2003 | | | 25% on 12/31/06, 07, 08 and 09 | | | 2.88 | | | $ | 348.00 | | | | 4,625 | |

| | 04/14/2003 | | | 20% on 12/31/06, 07, 08, 09 and 10 | | | 3.11 | | | $ | 357.75 | | | | 1,200 | |

| | 06/06/2003 | | | 25% on 12/31/07, 08, 09 and 10 | | | 3.25 | | | $ | 424.65 | | | | 375 | |

| | 07/01/2003 | | | 25% on 12/31/06, 07, 08 and 09 | | | 3.32 | | | $ | 411.00 | | | | 375 | |

| | 07/17/2003 | | | 25% on 12/31/06, 07, 08 and 09 | | | 3.37 | | | $ | 417.00 | | | | 300 | |

| | 08/01/2003 | | | 25% on 12/31/06, 07, 08 and 09 | | | 3.41 | | | $ | 409.00 | | | | 375 | |

| | 10/20/2003 | | | 25% on 12/31/06, 07, 08 and 09 | | | 3.63 | | | $ | 500.00 | | | | 12,500 | |

| | 01/01/2004 | | | 25% on 12/31/06, 07, 08 and 09 | | | 3.83 | | | $ | 466.00 | | | | 1,167 | |

| | 01/01/2004 | | | 25% on 12/31/07, 08, 09 and 10 | | | 3.83 | | | $ | 466.00 | | | | 1,311 | |

| | 02/06/2004 | | | 25% on 12/31/07, 08, 09 and 10 | | | 3.93 | | | $ | 460.00 | | | | 1,437 | |

| Totals | | | | | 1.36 | | | $ | 209.16 | | | | 373,154 | |

Concentration Ratio for Fiscal Year 2009:

The concentration ratio is defined by RiskMetrics Group as the total equity grants to the top five executives divided by the total equity grants to employees and directors. NVR did not grant any options to the top five executive officers during 2009.

54

A summary description of the principal terms and purpose of the 2010 Equity Plan is set forth below. This summary is qualified in its entirety by the detailed provisions of the 2010 Equity Plan, a copy of which is attached as Appendix D to this proxy statement.

General

The aggregate number of Shares which may be covered by fixed-price stock options (“option”) or time-vested restricted share units (“restricted share units”) granted pursuant to the 2010 Equity Plan is 700,000 Shares. Of the 700,000 aggregate Shares, up to 40%, or 280,000, may be granted in the form of time-vested restricted share units. Approximately one hundred and seventy (170) of our employees, including our named executive officers, and Board Members, will be eligible to participate in the 2010 Equity Plan. Unexercised options or restricted share units that terminate prior to the expiration of the 2010 Equity Plan will again be available for grant under the 2010 Equity Plan. The maximum number of Shares that can be granted under the 2010 Equity Plan to any executive officer or other employee of the Company is 100,000 in any calendar year. The total limit on Shares that may be covered by options and restricted shares granted under the 2010 Equity Plan and the individual limit on grants are subject to adjustment in the event of stock dividends, stock splits, recapitalizations or a similar change in outstanding Shares. Because participation and the types of awards under the 2010 Equity Plan are subject to the discretion of the Compensation Committee of the Board of Directors, the benefits or amounts that will be received by any participant or groups of participants if the 2010 Equity Plan is approved are not currently determinable.

The 2010 Equity Plan will be administered by the Compensation Committee which is comprised of six independent members of the Board. The Compensation Committee has the authority to make grants and to interpret the 2010 Equity Plan. The Compensation Committee has the authority to delegate to the Chief Executive Officer and the Senior Vice President of Human Resources, jointly, the authority to approve Option grants to participants other than to members of the Board and to our executive officers. Options granted pursuant to the 2010 Equity Plan are not intended to qualify as “incentive stock options” under Section 422 of the Internal Revenue Code. See “Federal Income Tax Consequences.”

An option may be exercised to the extent that Shares have vested under the option (as described below), in whole or in part, and at any time prior to expiration or termination of the option. Payment may be made in immediately available funds or by the assignment and delivery of Shares that are not subject to restriction and have a fair market value equal to the applicable Option Price less any portion paid in cash. The Committee may also authorize the use of broker-assisted cashless exercise. Shares will be issued in satisfaction of restricted share units as soon as administratively practicable after the vesting dates, but in no event later than March 15th of the year immediately succeeding a vesting date.

Options will be granted at an option price equal to the fair market value of the underlying Shares at the time the option is granted. Restricted share units are issued at a $0 exercise price. Fair market value of our Shares is generally determined by the closing price of the underlying Shares as reported by a national or regional stock exchange or other established securities market for publicly traded stock on the date immediately preceding the date of grant. The closing price of our Shares on March 5, 2010, as reported by the New York Stock Exchange, was $740.12 per share. Shareholder approval is required for any material amendment to the 2010 Equity Plan, including repricing option grants.

Each option shall be granted for a term of ten (10) years from the date of grant, subject to the limitations below; however, no option shall commence vesting, in whole or in part, prior to 2013,

55

except upon certain change of control events (as described below). Options granted pursuant to Option Agreements under the 2010 Equity Plan will become exercisable, in whole or in part, as to fifty percent of the underlying Shares on each of December 31, 2013 and 2014, respectively, subject to the limitations set forth below, or later, depending upon date of grant. Restricted share units will vest as to fifty-percent of the underlying Shares on each of December 31, 2011 and 2012, or later, depending upon date of grant. To date, there have been no grants of options or restricted share units under the 2010 Equity Plan.

An option or restricted share unit will terminate immediately and may no longer be exercised if the participant ceases to be an employee of NVR as a result of a termination for “cause” as defined in the 2010 Equity Plan, and, except as otherwise provided at the grant date, options may be exercised for a period of up to three months (one year in the case of death or disability) following a termination of employment other than for cause. In the event of an involuntary termination of employment, death, disability or retirement, the participant will be given additional pro rata vesting for the portion of the year prior to termination for determining exercisability. Any limitation on the exercise of an option contained in any Option Agreement may be rescinded, modified or waived by the Compensation Committee, in its sole discretion, at any time after the date of grant of such option. Notwithstanding the forgoing, no rescission, modification, or waiver to an Option Agreement shall materially improve a Participant’s benefits under the 2010 Equity Plan from those benefits approved by the shareholders. Options and restricted share units are non-transferable during the Optionee’s lifetime.

If we experience a change of control (as defined in the 2010 Equity Plan) and the equity awards are not assumed in the transaction, vesting of previously unvested options and restricted share units will be accelerated to the date of the change of control. NVR may provide that options that are not exercised prior to the change in control will terminate as long as vesting in the options were fully accelerated at the time of the transaction.

No amendment may increase the aggregate number of Shares subject to the 2010 Equity Plan, extend the term of the 2010 Equity Plan, or accelerate vesting of option or restricted share unit grants, except upon a change of control. Further,Shareholder approval is required to re-price any Options at an Option price less than the Option price specified at an original date of grant or to exchange any Options which have a price greater than the fair market value of Company stock at the time of the exchange for restricted share units. The Board may from time to time suspend or at any time terminate the 2010 Equity Plan.

Section 162(m) of the Internal Revenue Code limits publicly-held companies such as NVR to an annual deduction for federal income tax purposes of $1 million for compensation paid to their covered employees. However, performance-based compensation is excluded from this limitation. In the case of compensation attributable to the stock options, the stock options will be deemed to be performance-based if the options are granted by the compensation committee; the plan under which the option is granted states the maximum number of shares with respect to which options may be granted during a specified period to an employee; and under the terms of the option, the amount of compensation is based solely on an increase in the value of the common stock after the date of grant. The 2010 Equity Plan is designed so that the Options will qualify as performance-based for purposes of Section 162(m). However, the time-vested restricted shares will not qualify as performance-based even though shareholder approved, and will be subject to the 162(m) limit.

56

Federal Income Tax Consequences

The grant of a non-qualified option under the 2010 Equity Plan will result in no Federal income tax consequences to us or the Optionee at the grant date. Upon the exercise of an option granted under the 2010 Equity Plan, an Optionee will recognize ordinary income (subject to withholding taxes) in an amount equal to the difference between the exercise price and the fair market value of the Shares on the date of exercise. If we comply with applicable reporting requirements, we will be entitled to a business expense deduction in the same amount and at the same time as the Optionee recognizes ordinary income. Upon a subsequent sale or exchange of Shares acquired pursuant to the exercise of an option, the Optionee will have a taxable gain or loss, measured by the difference between the amount realized on the disposition and the tax basis of the shares (generally, the amount paid for the Shares plus the amount treated as ordinary income at the time the option was exercised).

If an Optionee surrenders Shares in payment of part or all of the exercise price for an option, no gain or loss will be recognized with respect to the Shares surrendered and the Optionee will be treated as receiving an equivalent number of Shares pursuant to the exercise of the option in a nontaxable exchange. The basis of the Shares surrendered will be treated as the substituted tax basis for an equivalent number of Option Shares received, and the new Shares will be treated as having been held for the same holding period as had expired with respect to the transferred Shares. The difference between the aggregate option exercise price and the aggregate fair market value of the Shares received pursuant to the exercise of the option will be taxed as ordinary income.

The grant of a restricted share unit under the 2010 Equity Plan will result in no Federal income tax consequences to us or the participant at the grant date. Upon the receipt of a Share in satisfaction of a restricted share unit award granted under the 2010 Equity Plan, a grantee will recognize ordinary income (subject to withholding taxes) in an amount equal to the fair market value of the Shares on the date of receipt. If we comply with applicable reporting requirements, we will be entitled to a business expense deduction for the year in which the restricted share units vested in the same amount as the participant recognizes ordinary income. Restricted share units will be subject to the 162(m) limitation as discussed above.

57

Shareholder Proposals

Shareholder proposals that are intended by a shareholder to be included in our proxy statement for our next annual meeting of shareholders pursuant to Rule 14a-8 of the Securities and Exchange CommissionSEC must be received in the office of NVR’s Secretary no later than November 22, 2010.25, 2013. Shareholder proposals that are not submitted for inclusion in our proxy statement pursuant to Rule 14a-8, but that one or more shareholders intend to propose for consideration at our next annual meeting, must be submitted to the office of NVR’s Secretary no earlier than November 22, 201025, 2013 and no later than December 22, 201025, 2013 and must otherwise comply with the conditions set forth in Section 2.04 of our bylaws (or, the case of director nominations, Section 3.03 of our bylaws)Bylaws). Any shareholder proposal that is not submitted within the applicable time frame will not be eligible for presentation or consideration at the next annual meeting.

Other MattersOTHER MATTERS

Management knows of no other business to be presented for action at the Annual Meeting, other than those items listed in the notice of the Annual Meeting referred to herein. If any other business should properly come before the Annual Meeting, or any adjournment thereof, it is intended that the proxies will be voted in accordance with the best judgment of the persons acting thereunder.

Our Annual Report on Form 10-K for 2009,2012, including consolidated financial statements and other information, accompanies this Proxy Statement but does not form a part of the proxy soliciting material. A complete list of the shareholders of record entitled to vote at our Annual Meeting will be open and available for examination by any shareholder, for any purpose germane to the Annual Meeting, between 9:00 a.m. and 5:00 p.m. at our offices at 11700 Plaza America Drive, Suite 500, Reston, Virginia 20190, from April 20, 201022, 2013 through May 3, 20106, 2013 and at the time and place of the Annual Meeting.

Copies of our most recent Annual Report onForm 10-K,, including the financial statements and schedules thereto, which we are required to file with the SEC will be provided in print without charge upon the written request of any shareholder. Such requests may be sent to Investor Relations, NVR, Inc., 11700 Plaza America Drive, Suite 500, Reston, Virginia, 20190. Our SEC filings are also available to the public from our website at http://www.nvrinc.com, and the SEC’s website at http://www.sec.gov.

| | | | |

| By Order of the Board of Directors,

| |

| |  | |

| |

| James M. Sack | |

| | Secretary and General Counsel | |

|

Reston, Virginia

March 22, 2010

58

50

Appendix A

Nominating Committee Policies and Procedures for the Consideration of

Board of Director Candidates

The following amended and restated policies and procedures were adopted by the NVR, Inc. (the “Company”) Nominating Committee (the “Committee”) on November 1, 2005:

February 19, 2013:| I. | | Policy Regarding Director Candidates Recommended by Security Holders. |

| A. | | The Company will consider all director candidates recommended by shareholders owning at least 5% of the Company’s outstanding shares at all times during the preceding year that meet the qualifications established by the Board of Directors (the “Board”). |

A. The Company will consider all director candidates recommended by shareholders owning at least 5% of the Company’s outstanding shares at all times during the preceding year that meet the qualifications established by the Board of Directors (the “Board”).

| II. | | Director Minimum Qualifications. |

| | A. | | Each director nominee is evaluated in the context of the full Board’s qualifications as a whole, with the objective of establishing a Board that can best perpetuate the success of the Company’s business and represent shareholder interests through the exercise of sound judgment. Each director nominee will be evaluated considering the relevance to the Company of the director nominee’s respective skills and experience, which must be complementary to the skills and experience of the other members of the Board; |

|

| | B. | | A substantial majority of the Board shall be independent as defined by the applicable exchange on which the Company’s shares are listed. The Audit, Compensation, Corporate Governance, Nominating and Qualified Legal Compliance Committees will be comprised solely of independent directors;directors who shall satisfy any independence requirements applicable to members of such committees under federal securities laws and the rules of the exchange on which the Company’s securities are listed; |

|

| | C. | | Director nominees must possess a general understanding of marketing, finance and other elements relevant to the success of a large publicly-traded company in today’s business environment, and an understanding of the Company’s business on an operational level; |

|

| | D. | | Each director may be assigned committee responsibilities. A director nominee’s educational and professional backgrounds must be consistent with the director nominee’s committee assignment (e.g., director nominees who will be assigned to the audit committeeAudit Committee must be financially literate as defined within the Company’s Audit Committee Charter); |

|

| | E. | | Director nominees must demonstrate a willingness to devote the appropriate time to fulfilling Board duties; |

1

| | F. | | Director nominees shall not represent a special interest or special interest group whose agenda is inconsistent with the Company’s goals and objectives or whose approach and methods are inconsistent with what the Board believes is in the best interest of the Company’s shareholders; and |

|

A-1

| | G. | | Director nominees shall not be a distraction to the Board, nor shall a director nominee be disruptive to the achievement of the Company’s business mission, goals and objectives. |

| III. | | Procedures for Consideration of Security Holder Nominations. |

| | A. | | Security holder nominations must includeALLof the information described in paragraphs C. through H. below and must be received in its entirety by the 120th calendar day before the date of the company’s proxy statement released to security holders in connection with the previous year’s annual meeting to be considered for the next scheduled annual meeting of shareholders; |

|

| | B. | | Security holder nominations must be in writing and submitted via registered mail or overnight delivery service to the Nominating Committee Chairman at the Company’s corporate headquarters’ address; |

|

| | C. | | Supporting documentation must be submitted that allows the Nominating Committee to verify ownership of not less than 5% of the Company’s outstanding shares at all times during the immediately preceding year; |

|

| | D. | | The shareholder must submit an affidavit from the director nominee stating that if elected, the director nominee is willing and able to serve on the Company’s Board for the full term to which the director nominee would be elected. The affidavit must also acknowledge that the director nominee is aware of, has read and understands the Company’s Code of Ethics, Standards of Business Conduct, Corporate Governance Guidelines, and Board of Director Committee Charters (collectively, the “Corporate Governance Documents”), and further that the director nominee acknowledges that, if elected, the director nominee is subject to and will abide by the Corporate Governance Documents; |

|

| | E. | | The director nominee must submit a signed independence questionnaire. This questionnaire shall be distributed to the director nominee upon receipt of a properly delivered security holder director nomination request, and must be returned within five days of receipt via registered mail or overnight delivery service to the Company’s Corporate Secretary and Nominating Committee Chairman, or designee; |

|

| | F. | | The shareholder must submit documentation as to the director nominee’s qualifications, which at a minimum must include: |

2

| | 2. | | Full employment history, including current primary occupation; |

|

| | 3. | | A signed consent form and waiver authorizing the Company to perform a full background investigation of the director nominee, including criminal and credit history, from a security firm acceptable to the Company in its sole discretion, an original report of which must be sent directly from the security firm to the Company’s Corporate Secretary and Nominating Committee Chairman, or designee; |

|

A-2

| | 4. | | Documentation of educational levels attained, complete with official transcripts issued directly by the educational institution and sent directly from the educational institution to the Company’s Corporate Secretary and Nominating Committee Chairman, or designee. The Nominating Committee may waive this requirement if the security firm performing the background investigation verifies that the director nominee completed the educational levels indicated by the director nominee; |

|

| | 5. | | Disclosure of all special interests and all political and organizational affiliations; and |

|

| | 6. | | A complete list of clients if the director nominee is a consultant, attorney or other professional service provider; |

| | G. | | The shareholder must submit any additional information required to be included in the Company’s proxy statement for director nominees which determination will be made by the Company in its sole and absolute discretion (including, without limitation, information regarding business experience, involvement in legal proceedings, security ownership and transactions with the Company or management); and |

|

| | H. | | The information submitted by the security holder must include relevant contact information (e.g., address, phone numbers) for the submitting shareholder and the director nominee. |

| IV. | | Identification and Evaluation of Director Candidates. |

| | A. | | For directors standing for reelection, the Nominating Committee may consider: |

| | 1. | | The general qualifications as noted above; |

|

| | 2. | | The director’s attendance at Board and Committee meetings; and |

|

| | 3. | | The director’s participation and contributions to Board activities. |

3

| | B. | | The Nominating Committee may consider the following when identifying and evaluating an individual who is not currently a Company director: |

| | 1. | | Use of outside executive search firms or referrals, as appropriate; and |

|

| | 2. | | Consideration of the Company’s minimum director qualifications as noted above in light of the specific qualifications possessed by the individual being considered; and |

| | C. | | Regardless of the source of the nomination, individuals being considered for nomination to the Company’s Board, who are not currently directors, must provide to the Company the information described in Section III, paragraphs D —– H. |

4

A-3

Appendix NVRIMPORTANT ANNUAL MEETING INFORMATION 000004

ENDORSEMENT LINE SACKPACK

MR A SAMPLE